what is tax relief

We hold your satisfaction to the highest priority and you can be rest assured that your decision to choose us. Immediate Tax Relief Help BBB A Rated Tax Professionals Remove Tax Levies Liens Stop Wage Garnishments Offer in Compromise Help 8775503911 IRS Tax Relief Consultant Whether you are facing issues with your businesss finances or personal finances Anderson Bradshaw has a tax professional that can help you through your unique tax.

Tax Benefit Rule Previous Deduction Recovery Los Angeles Cpa

Landlords in higher tax brackets could then end up paying much more tax than before as theyll be paying a percentage of the total rental income rather than the rental income minus their yearly mortgage interest payments.

. The deduction is available for sales made in July 2022 August 2022 and September 2022. 17 tax extension deadline SC-2022-06 IRS announces tax relief for victims of Hurricane Ian in South Carolina NC-2022-10 IRS announces tax relief for victims of Hurricane Ian in North. Approved postgraduate courses in private and publicly funded colleges in the State.

The film must pass a cultural test or qualify through an internationally agreed co-production treaty. Absent direct state guidance on the treatment of student loan debt relief affected taxpayers should consult with a tax preparer. Reckless federal spending sent inflation rates spiraling higher than weve seen in generations and.

TCA 67-5-701 through 67-5-704. Other charges and levies do not qualify for relief such as. You can get immediate access to the credit by reducing the employment tax deposits you are otherwise required to make.

The disparities in states treatment of student debt relief are rooted in what is known as Internal Revenue Code conformity the degree to which a states tax code matches the federal one. Maine Revenue Services administers several programs aimed at providing eligible Maine taxpayers with tax relief. About The Taxpayer Relief Act.

Relief from Capital Gains Tax CGT when you sell your home - Private Residence Relief time away from your home what to do if you have 2 homes nominating a home Letting Relief. The Taxpayer Relief Act Act 1 of Special Session 1 of 2006 was signed into law on June 27 2006. Includes Corporation Tax Capital Gains Tax Construction Industry Scheme CIS and VAT.

IR-2022-177 IRS expanding dyed diesel penalty relief as a result of Hurricane Ian IR-2022-175 IRS. Find disaster tax relief information and resources. The guidance issued today addresses unanticipated changes in expenses because of the 2019 Novel Coronavirus COVID-19 pandemic and provides that previously provided temporary relief for high deductible health plans may be applied retroactively to January 1 2020 and it also increases for inflation the 500 permitted carryover amount for.

The Tax Relief Program began in 1973 as a result of the 1972 Question 3 constitutional amendment. The COVID-related Tax Relief Act of 2020 enacted December 27 2020 amended and extended the tax credits and the availability of advance payments of the tax credits for paid sick and family leave under the FFCRA. A claimant must be an owner or co-owner of the original property as a joint tenant a tenant in common or a community property owner.

The Florida Houses tax package the largest middle-class tax relief package in the history of the state is now the law of the land said Speaker Chris Sprowls. At Republic Tax Relief our philosophy is to treat all of our clients with the utmost care and respect with professional integrity and confidentiality. Income Tax Credits Individual income tax credits provide a partial refund of property tax andor rent paid during the tax year.

Tax relief is available for tuition fees paid for. This is being phased in from 6 April 2017 and will be fully in. Dont miss this important Oct.

Tax reliefs for charities As a charity you do not pay tax on most of your income and gains if you use it for charitable purposes - this is known as charitable expenditure. Español 703-324-3855 between 800 am. Postgraduate courses in a university or publicly funded college in another EU member state or the UK including such colleges that provide distance education in the State.

2020 provided transition relief for employers that hired certain individuals residing in empowerment zones by extending the 28-day. Latest Updates on Coronavirus Tax Relief Penalty relief for certain 2019 and 2020 returns. A claimant is any person claiming Proposition 6090 property tax relief.

To help struggling taxpayers affected by the COVID-19 pandemic the IRS issued Notice 2022-36 PDF which provides penalty relief to most people and businesses who file certain 2019 or 2020 returns lateThe IRS is also taking an additional step to help those who paid these penalties already. The tax relief that landlords of residential properties get for finance costs is being restricted to the basic rate of Income Tax. Single or married filing jointly with or without dependents.

Since 1937 our principled research insightful analysis and engaged experts have informed smarter tax policy at the federal state. Property tax reduction will be through a homestead or farmstead exclusion. File schedules on your individual or joint return for small business home-based business investment properties or rental unit income.

Children Tax Credit. Limited Special Deduction Available for July August and September 2022 House Bill 22-1406 allows qualifying retailers to claim a limited special deduction from state taxable sales under certain conditions and to retain and spend the resulting state sales tax. A spouse of the claimant is also considered a claimant if the spouse is a record owner of the replacement dwelling and thus must provide.

The Tax Relief section processes these applications and determines eligibility for the program. Wage income and earned interest. The Tax Foundation is the nations leading independent tax policy nonprofit.

A bill like this has never been more needed than it is right now. And the only tax relief theyll receive is 20 of their interest payment instead of the entire amount. You can claim tax relief on qualifying fees including the student contribution that you have paid for third level education courses.

The qualifying fees must be paid for an approved course at an approved college. The Taxpayer Relief Act provides for property tax reduction allocations to be distributed by the Commonwealth to each school district. Create and file your tax return Now.

To qualify for creative industry tax reliefs all films must be certified as British. You can easily enter your W-2. Fairfax County provides real estate tax relief and vehicle tax relief only one vehicle per household to citizens who are either 65 or older or permanently and totally disabled and meet the income and asset eligibility requirementsQualified taxpayers may also be eligible for tax relief for renters.

Each year over 100000 individuals receive benefits from this 41000000 plus program. For an application call 703-222-8234. The Work Opportunity Tax Credit WOTC is a Federal tax credit available to employers for hiring and employing individuals from certain targeted groups who have faced significant barriers to employment.

Hurricane Ian Brings Tax Relief For Those Affected Southwest Florida Business And Ip Blog

12 Explosive Tax Deductions For Restaurant Owners

Property Tax Relief Ways To Get Texas Property Tax Relief Tax Ease

5 Best Tax Relief Companies Of 2022 Consumersadvocate Org

4 563 Tax Relief Images Stock Photos Vectors Shutterstock

Irs Tax Relief Scams How To Protect Yourself Landmark Tax Group

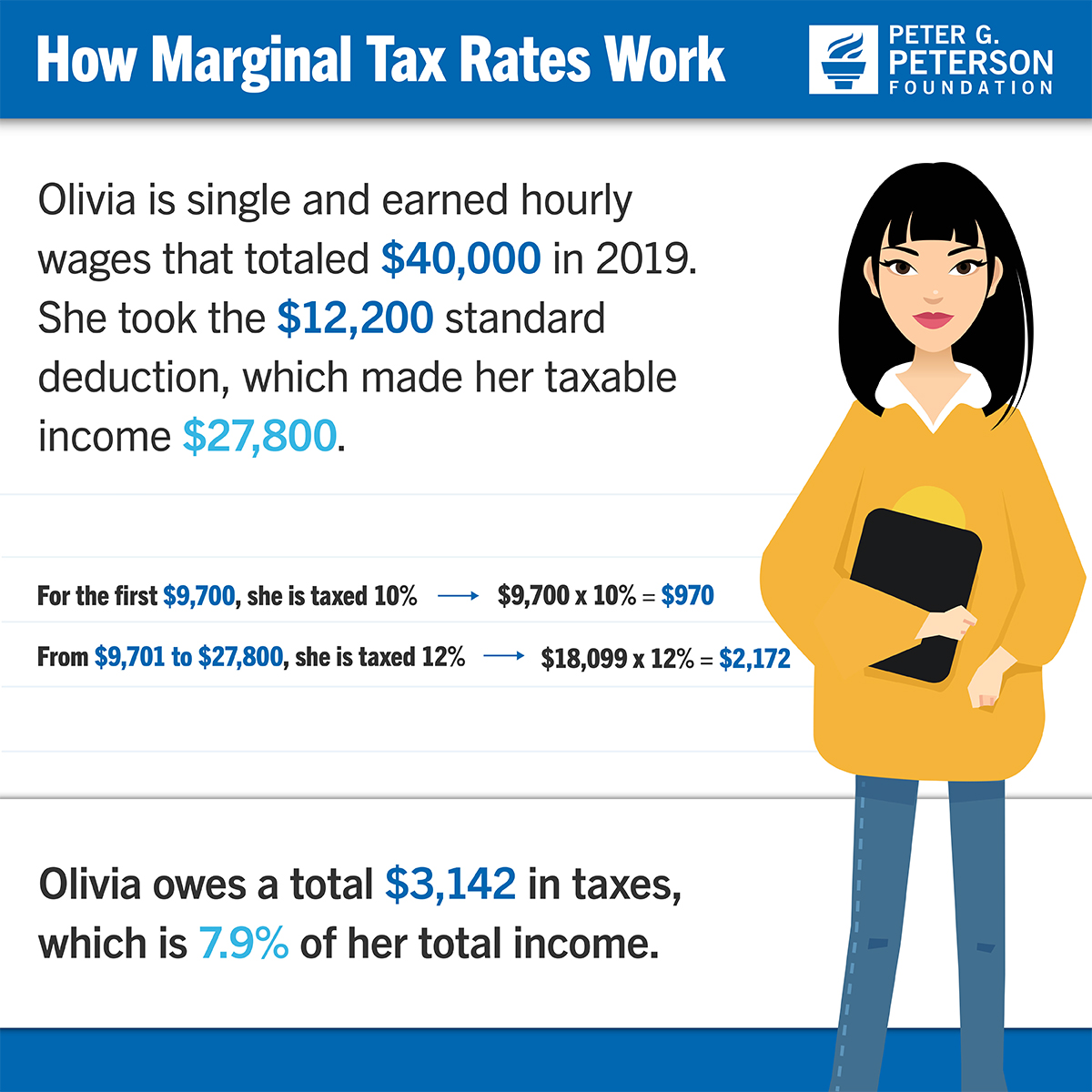

Four Simple Scenarios That Show How Marginal Rates And Tax Breaks Affect What People Actually Pay

Tax Relief Rubber Stamp Royalty Free Vector Image

Nebraskans Failing To Claim 200 Million In State Income Tax Credits Officials Say Nebraska Examiner

What Is A Tax Credit Vs Tax Deduction Do You Know The Difference

What Are Tax Credits And How Do They Differ From Tax Deductions Tax Policy Center

2022 State Tax Reform State Tax Relief Rebate Checks

Tax Deductions Lower Taxes And Tax Liability Higher Refund

/dotdash_Final_What_Tax_Breaks_Are_Afforded_to_a_Qualifying_Widow_Nov_2020-01-c5d6697fa005491f8a0049780f7c2b82.jpg)

What Tax Breaks Are Afforded To A Qualifying Widow

Tax Credit What It Is How It Works What Qualifies 3 Types

Honolulu Hi Irs Tax Representation Tax Resolution Tax Help Tax Relief Services Home

Fidelity Tax Relief Llc Home Facebook

Tax Relief For Elderly Disabled York County Va

7 Best Tax Relief Companies 2022 Our Picks For Tax Debt Help

0 Response to "what is tax relief"

Post a Comment